The maritime industry is probably one of the few large industries that has little intersection with the man on the street despite it being a labour-intensive one and its impact on our lives. Not counting the passenger markets, the container segment is the only segment that is partially B2C in the business of carriage of goods by sea. All other seaborne trades including Tankers, Bulkers, Offshore, specialised ones like car carriers, live stock carriers, etc. are all B2B. This explains why little is known about the maritime sector beyond the container segment, and it is off the radar from most consumers and the media except for some instances of no good reasons.

However, this little known industry has gotten a lot of attention from the ‘outsiders’ along with the advent of the ever-growing power of Internet technology and the disruption wave. In a few short years, many technology startups, lured by the huge maritime market value, have started to try to disrupt it from various angles including: platform for freight, bunker procurement; optimiser for maritime supply chain; efficiency tools for ship-management, ship-operations, ship-routing, etc. A handful of them have started to obtain more serious funding in tens of million dollars with a top one achieving over a 100 recently, mainly focused in the container arena. Still, judging from the reactions from the maritime commerce and the industry as a whole, they are not yet good reflections of what we can optimistically see as a positive convergence between maritime and technology with good results.

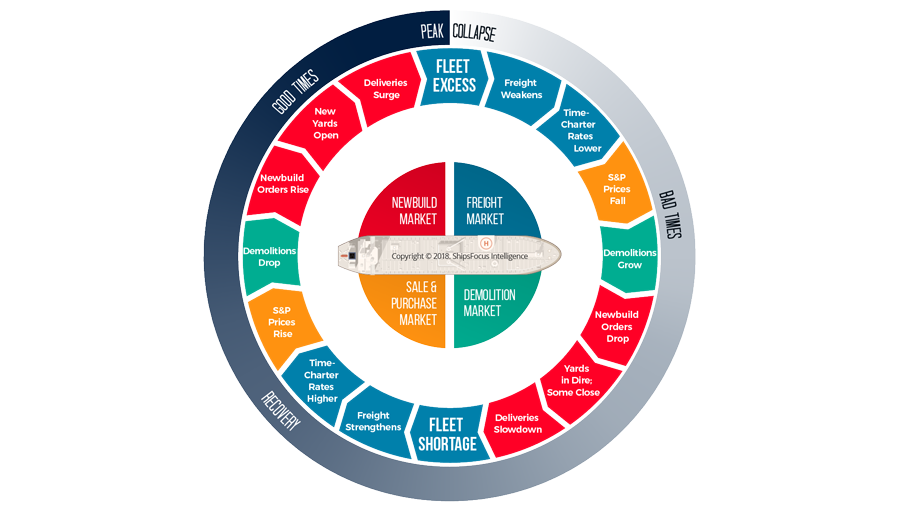

In this 3rd part of a Maritime Disruption series I am writing, I’d like to highlight several key characteristics of maritime commerce which involves 4 shipping markets as shown in the centre of the graphic above:

Global & Capital Intensive: Since time immemorial, maritime shipping has always grown to support international seaborne trades. At the same time, the low cost of maritime shipping has enabled more trades and boosted globalisation. A ship is an expensive asset that can easily cost between $10 million and $100 million or more. Both the ship-owner and ship-operator have to spend a great amount of money and manpower to maintain it and the equipment on board. Inherently challenging, the operator has to operate an expensive and high-opex asset to enable a low-freight service.

Reactive in Nature: Maritime shipping exists to support seaborne trades it relies on. It is a ‘derived demand’: a demand for a ship or its space is a consequence of a demand for a trade or product a trader buys or sells and needs to ship. Therefore, the maritime industry is generally reactive in nature. Like a tug waiting in port to take a vessel into the port and its berth, it has the wait until the vessel arrives and is ready. Similarly the vessel does not have full control, and needs to wait for its cargo-customer to decide when she can berth.

Challenge Intensive: Ships only make money for their owners and operators when they are moving. However, during a sea voyage, a ship is subject to the elements, which will put itself, its officers and crew on board to test. When a ship is in port, including while loading and discharging, there are many factors that prolong its operations. A ship-owner and ship-operator have to contend with regulatory, commercial, operational, financial, and many other challenges in a 24/7/365 business.

‘Dis-aligned’ Supply: Ship supply is inelastic because of the long time (12-18 months or longer) it takes to build a ship, from order to delivery. This makes aligning supply and demand innately difficult. Furthermore, with ‘easy money’ and ‘financialisation of shipping’ and other factors, building of ships and adding capacity is no longer necessarily directly tied to the demand anymore. This ‘dis-aligned’ supply now plays havoc to an already cyclical nature of maritime commerce that goes through boom and bust, usually with long bad and recovery time and short good time.

Labour Intensive, Long Chain, Manual & Paper based Non-Standardised Operations: The need to keep the expensive ship running smoothly and comfort its owner and operator to sleep at night has enabled a broad range of services and intermediaries to develop. These services include ship-agencies, ship-chandlers, ship-brokers, consultants, port services (towage, launch, pilotage) providers, etc. This labour-intensive maritime commerce has mainly relied on disparate systems, manual and non-standardised processes, and physical paper to conduct their business. The tech tools they use are the telephone, fax, SMS, some Internet-based instance messaging apps. Despite all these, they are four highly efficient markets where rarely a demand cannot find a supply and vice versa.

Highly Fragmented: Unlike the container segment, the other key freight segments are very fragmented with a majority made up of privately run big, medium and small companies and few generally larger publicly listed ones. Many small maritime commerce companies survive or thrive on their ability to offer niche services. But smaller ones also tend to be more susceptible to disruption. However, research of their performances is difficult and rare, therefore, much has to rely on the few experts who have spent a considerable amount of time and research energy in their respective segments.

Differentiation & Positioning: Innovation in maritime commerce does not last as a new model is quickly duplicated. So, it is hard to sell a differentiated service for long. This is even so in a specialised segment like chemical & parcel shipping. Stolt Nielsen and Odfjell Tankers have been exceptionally able to distinguish themselves, largely through their technical expertise to the level of institutional knowledge. However, many companies, especially smaller ones, have found their own niches by specific and creative positioning. The losers are usually the ones, big and small, that seek expansion of market share, often in the name of gaining economies of scale and flexibility of service, only to achieve them at the expense of their own profit margin. More and more shipping companies now are looking more seriously at innovative ideas to reduce their opex.

These are several key characteristics of the maritime commerce. I hope knowing these can help potential tech disruptors understand maritime commerce in general, and that any undertaking to transform it may be as big as the disruption it will bring about.

In the next part of the series, I will discuss about digitalisation and what the maritime and tech people can do. Please share it. Thank you!

This is my small bit in demystifying maritime commerce and innovation, please share this article if you find it helpful. Thank you!

Author’s LinkedIn Profile:

<script src="//platform.linkedin.com/in.js" type="text/javascript"></script>

<script type="IN/MemberProfile" data-id="https://www.linkedin.com/in/chye-poh-chua-bb022954" data-format="inline" data-related="false"></script>

I invest, mentor and grow a group of startups which specialize and focus on creative maritime commerce innovations and solutions via digitalization, data-science applications, work tools, etc.

I believe for now, ShipsFocus’ maritime venture studio model is an appropriate one to most efficiently and effectively overcome the BIG innovation conundrum.