Shipping big data can help stakeholders to better understand how ships, cargoes and freight move. We use them to expand the traditional data sets and analytics to offer a more complete picture of the business. By analysing such large amounts of information, both structured and unstructured, we can give clarity in challenges, opportunities and treatment options almost immediately, enabling our clients better decisions and strategic business moves. Here are some examples:

Operators and their ships are part of the trades they enable. From our data, analytics, curated trade patterns and forecasts, they unveil supply & demand insights that empower our clients to better position themselves. You can now better predict and plan for the expansion or re-deployment of your fleet.

Enlarge iFrame

A successful port has to deal with myriad problems including congestion, security and safety issues involving multiple port services providers, users and authorities. Applying available ships AIS data with our domain knowledge, we provide clarity that enables solution development in these issues.

The issues plaguing carriers, port terminals and their customers are not just related to ships’ prolonged port stay, but as much in uncertainty and unpredictability of their turnaround. Our big data applications focus on providing ever clearer data, information and coordination that aim to eradicate such issues.

There are many shipping issues to solve. For a big and far one, our vision is set on Aggregated Shipping which becomes possible with the advent of platform, A.I. & other technologies, a tech-ready workforce and tech-reliant environment. However, like everything else, we start small with practical solutions that give immediate returns to front line personnel and their managers. Cultivating data, parsing data and preparing data is our main focus, without which A.I. in shipping remains as hype. Below are some examples of our A.I. applications:

Shipbrokers currently monitor future ship positions via manual surveys. Applying a predictive algorithm from machine learning based on past and current positional data, we can offer predictable future vessel positions, enabling shipbrokers a better grasp of supply.

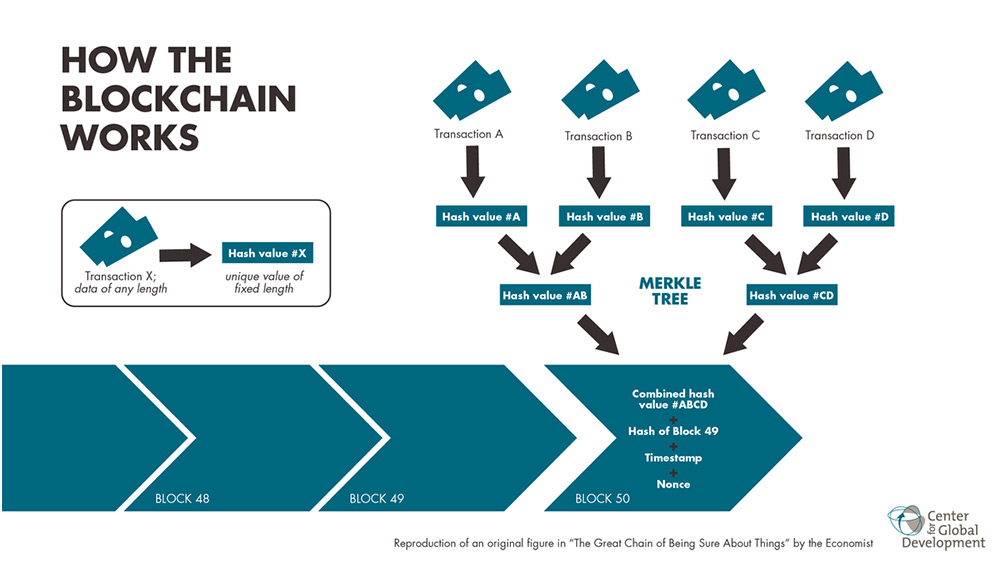

Like all advanced technologies, Blockchain technology probably holds the most promise for maritime shipping and its adjacent industries. However, obstacles that befall its meaningful applications and main stream usage before its maturity are just as great for the time being. Our approach, again is a practical one. We have identified areas where a permissioned Blockchain can offer realistic solution, and are working in these areas. We welcome potential collaborators who believe in creating synergetic value in this regard.

DISTRIBUTED LEDGER TECHNOLOGY

We co-design and develop applications with our collaborators so they minimise customisation cost. All these applications come with a dashboard that simplifies complex data sets, reveals patterns, and for users to monitor business performance at a glance. Our dashboards use data visualization which improves user experience of traditional business intelligence. They are design-focused, thoughtful, user-friendly dashboards and communicate the most important information and metrics with clarity, simplicity, and most of all, accuracy. Below is a couple of examples:

Write and give us your feedback. We appreciate it!